Managing money doesn’t come naturally to most people—it’s something we learn through experience, mistakes, or, if we’re lucky, through guidance from those who’ve mastered it.

While the internet is full of quick tips and viral hacks, nothing compares to sitting down with a truly transformative personal finance book. The right book can shift your mindset, reshape your habits, and put you on a path to long-term financial freedom.

The beauty of these books is that they don’t just teach math—they teach mindset. They show you how to think about money, value, and purpose in ways that stick.

Whether you’re trying to get out of debt, save for the future, or finally build wealth, these ten books have changed millions of lives—and they might just change yours too.

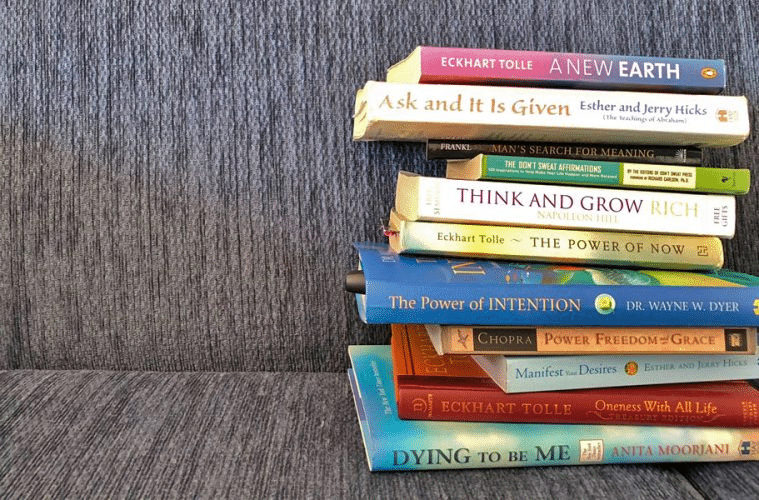

10 Personal Finance Books That Change Lives

Each of these titles offers timeless lessons, real-life examples, and practical steps to help you transform your relationship with money.

1. “Rich Dad Poor Dad” by Robert Kiyosaki

This classic flips everything you thought you knew about money upside down. Kiyosaki contrasts the lessons he learned from his two father figures—his “poor dad” (his biological father) and his “rich dad” (his best friend’s father). The book’s main message? Financial education matters more than formal education.

It teaches readers the importance of assets over liabilities, how to make money work for you, and why building wealth isn’t about earning more—it’s about thinking differently. It’s an eye-opener for anyone stuck in the paycheck-to-paycheck mindset.

2. “The Total Money Makeover” by Dave Ramsey

Dave Ramsey’s no-nonsense approach to money has made him one of the most trusted voices in personal finance. In The Total Money Makeover, he lays out a step-by-step plan to help you get out of debt, build savings, and create a stable financial foundation.

Ramsey’s “Baby Steps” method is simple but effective. It starts with saving a small emergency fund, then moves on to paying off all debt using the “debt snowball” method. It’s a great book for anyone looking for structure, discipline, and motivation to finally take control of their money.

3. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book isn’t just about saving money—it’s about redefining your relationship with it. Robin and Dominguez challenge readers to see money as something that represents their time and energy, not just their income.

The book’s message is deeply philosophical yet incredibly practical. It teaches you how to track spending, live intentionally, and align your finances with your personal values. Many readers call it life-changing because it helps them see money as a tool for freedom rather than stress.

4. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Most millionaires aren’t flashy—they’re quiet, disciplined savers who live below their means. That’s the surprising truth revealed in The Millionaire Next Door. Based on years of research, the book shatters the myth that wealth equals luxury.

It shows that true financial success comes from consistent habits like budgeting, investing, and avoiding unnecessary debt. This book will change the way you view status symbols and help you understand what real wealth looks like behind the scenes.

5. “I Will Teach You to Be Rich” by Ramit Sethi

Ramit Sethi’s energetic and modern take on money makes personal finance feel exciting instead of intimidating. His six-week program helps you automate finances, invest wisely, and enjoy your money without guilt.

Unlike many financial gurus, Sethi encourages spending on what you love—as long as you cut costs mercilessly on the things you don’t. His approach is especially appealing to younger readers who want financial freedom and lifestyle flexibility.

It’s smart, practical, and full of actionable advice you can implement immediately.

6. “The Psychology of Money” by Morgan Housel

This is not your typical finance book—it’s a collection of stories that explore how people think, feel, and behave around money. Housel explains that financial success isn’t just about intelligence; it’s about behavior.

He dives into the emotional side of wealth—why people make irrational choices, how luck and timing shape outcomes, and why contentment often matters more than returns. It’s a powerful reminder that managing money is as much about psychology as it is about numbers.

This book changes the way you view risk, greed, and happiness.

7. “Atomic Habits” by James Clear

While not strictly a finance book, Atomic Habits is a game-changer for anyone trying to transform their financial life. Clear shows how small, consistent actions compound into massive results—a principle that applies perfectly to saving, investing, and budgeting.

He teaches the science of habit formation, explaining how to make good behaviors effortless and bad ones hard. If you’ve ever struggled to stick to a budget or save consistently, this book gives you the mindset and tools to make change last.

Money success begins with daily habits—and this book shows exactly how to build them.

8. “The Simple Path to Wealth” by JL Collins

Born from letters the author wrote to his daughter, The Simple Path to Wealth is a heartfelt and straightforward guide to building financial independence through investing. Collins explains complex concepts like index funds, compound interest, and market behavior in plain English.

His philosophy is simple: spend less than you earn, invest the rest, and let time work its magic. There’s no fluff or jargon—just practical wisdom that has inspired an entire movement of financially independent investors.

If you’ve ever been intimidated by investing, this is the book that will make it click.

9. “Broke Millennial” by Erin Lowry

Targeted at young adults, Broke Millennial tackles the real-life money struggles of a generation facing student loans, side hustles, and rising living costs. Lowry mixes humor with practical advice to help readers get financially confident without feeling judged.

She covers everything from negotiating raises to splitting bills with friends and managing relationships with money. Her down-to-earth style makes the topic relatable and empowering—perfect for anyone starting their financial journey.

It’s like having a money-savvy older sister who’s been through it all and wants to see you win.

10. “Think and Grow Rich” by Napoleon Hill

Written nearly a century ago, Think and Grow Rich remains one of the most influential books on wealth ever written. Hill studied some of the world’s most successful people—including Henry Ford and Andrew Carnegie—to uncover the common traits that led to their achievements.

The book is less about financial strategy and more about mindset. It teaches the power of focus, persistence, and belief in your goals. Many of today’s top entrepreneurs and investors credit this book for inspiring their success.

It’s proof that wealth starts in the mind long before it shows up in your bank account.

Conclusion

Money management is a lifelong journey, and these books are the perfect companions along the way. They teach not just how to earn, save, and invest—but how to think about money in a way that empowers you.

Each of these authors offers a unique perspective, but they all share one truth: financial freedom begins with knowledge. Whether you’re trying to get out of debt, start investing, or change your mindset around wealth, these books offer lessons that can truly transform your life.

So pick one, start reading, and remember—every chapter brings you closer to a future where you control your money, not the other way around.

See more:

7 Budgeting Methods That Actually Work

7 Budgeting Methods That Actually Work  South Africa’s Capitec profit rises 84%

South Africa’s Capitec profit rises 84%