President’s Choice Financial®️ World Elite Mastercard®️

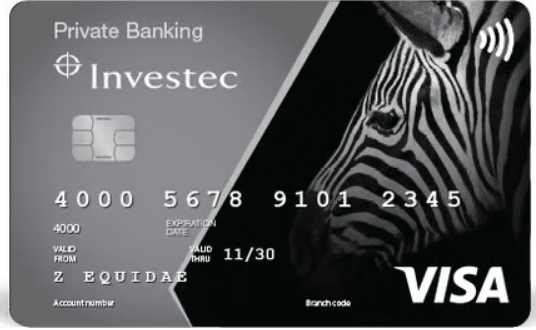

Attractive rates Premium rewards programIn the world of exclusive financial products, the Investec Private Banking Credit Card stands out as a premier choice for individuals seeking unparalleled service and sophisticated financial tools.

This card is designed for those who demand excellence in their financial management and wish to leverage a range of premium benefits.

Whether for personal or business use, the Investec Private Banking Credit Card offers a suite of features that cater to the needs of high-net-worth clients, making it an ideal choice for those who value both luxury.

The Investec Private Banking Credit Card offers a comprehensive array of financial management tools tailored to the needs of discerning clients.

With access to personalized financial advice, you can receive expert guidance on investment strategies, wealth management, and estate planning.

The card also provides sophisticated budgeting tools and spending analysis, allowing you to maintain a clear overview of your financial health and make informed decisions.

These tools are designed to help you manage your wealth effectively and ensure your financial strategies align with your long-term goals.

Unlock Elite Financial Solutions with the Investec Private Banking Credit Card

Pros and Cons

Pros

- Comprehensive financial management: Access to personalized financial advice, sophisticated budgeting tools, and spending analysis ensures effective wealth management and alignment with long-term goals.

- Exclusive travel and lifestyle benefits: Complimentary airport lounge access, comprehensive travel insurance, and concierge services enhance your travel and daily life experiences.

- Unmatched rewards and privileges: Earn points on every purchase and redeem them for travel, merchandise, and exclusive experiences, with additional perks like preferential rates on loans.

Cons

- High eligibility criteria: The Investec Private Banking Credit Card may have stringent eligibility requirements, making it less accessible to a broader audience.

- Annual fee: The card comes with a high annual fee, which could be a consideration for some potential cardholders when evaluating the overall benefits.

How Do I Know if the Investec Private Banking Credit Card is Right for Me?

Determining if the Investec Private Banking Credit Card is the best fit for you depends on your financial goals, lifestyle, and spending habits.

If you are a high-net-worth individual seeking personalized financial management tools and expert advice, this card offers the services and support you need to manage your wealth effectively.

Consider the exclusive travel and lifestyle benefits, as well as the comprehensive rewards program, to see if they align with your preferences and enhance your daily experiences.

Additionally, if you value exclusive privileges and unmatched rewards that provide exceptional value and service, the Investec Private Banking Credit Card delivers the features you need to elevate your banking experience.

Evaluate the card’s benefits, potential limitations, and associated costs against your financial objectives to determine if it meets your requirements and offers the value you seek in a premium credit card.

As a holder of the Investec Private Banking Credit Card, you gain access to a host of exclusive travel and lifestyle benefits that enhance your daily life and travel experiences.

Enjoy complimentary access to airport lounges worldwide, providing a luxurious and comfortable environment as you wait for your flights.

Why Do We Like This Card?

We like the Investec Private Banking Credit Card for its comprehensive financial management tools, exclusive travel and lifestyle benefits, and unmatched rewards and privileges.

This card offers personalized financial advice and sophisticated budgeting tools, ensuring effective wealth management.

The exclusive travel benefits, such as airport lounge access and travel insurance, enhance your travel experiences, while the concierge services make daily life more convenient.

The rewards program and additional privileges provide exceptional value, making each transaction more rewarding.

With its focus on luxury, convenience, and comprehensive financial solutions, the Investec Private Banking Credit Card is an excellent choice for high-net-worth individuals seeking an elite banking experience.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply