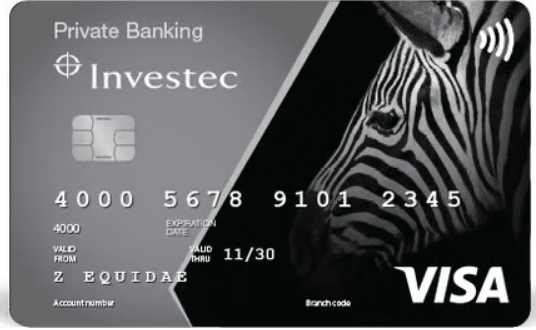

With competitive rates, generous rewards and personalized concierge services, this card offers a unique experience.

The attractive rates allow cardholders to optimize their spending, while the premium rewards program allows them to accumulate points to redeem for travel, luxury products and exclusive experiences.

In addition, the card provides access to VIP lounges at airports and concierge services that adapt to customers’ needs, assisting with bookings, travel planning and more. These exclusive benefits highlight the card as an option for those seeking convenience and excellence in their financial services.

The combination of these features makes the Investec Private Banking Credit Card an attractive choice for those looking to elevate their financial status.

With personalized service, remarkable rewards and premium perks, the card offers more than just a line of credit – it provides a complete luxury experience for customers who value the best.

President’s Choice Financial®️ World Elite Mastercard®️

Attractive rates Premium rewards programHow the Investec Private Banking Credit Card works

The Investec Private Banking Credit Card offers cardholders access to a line of credit that can be used for purchases and payments. With competitive rates, customers can manage their expenses efficiently.

In addition, the rewards program allows you to accumulate points with each transaction, which can be redeemed for travel, luxury products and exclusive experiences.

The card also provides personalized concierge services, assisting with reservations, travel planning and other needs.

With benefits such as access to VIP lounges at airports, the card offers a complete and differentiated financial experience.

Benefits of the Investec Private Banking Credit Card

The Investec Private Banking Credit Card offers several exclusive advantages. With competitive rates, it allows efficient financial management.

Its rewards program provides accumulation of points to exchange for travel and luxury products. Personalized concierge services assist with reservations and travel planning. Access to VIP lounges at airports adds convenience to travel.

It also offers travel insurance and global assistance. Its customer-focused approach, combined with premium benefits, makes it an attractive choice for those seeking a sophisticated and rewarding financial experience.

Disadvantages of the Investec Private Banking Credit Card

While the Investec Private Banking Credit Card offers several advantages, it also has some considerations. Competitive rates may still be higher than those of other credit cards.

The rewards program, while attractive, can have complex redemption requirements. Also, eligibility for the card may be restricted to high-income customers.

These restrictions may limit access to certain individuals. Therefore, it is important to carefully assess whether the advantages outweigh the disadvantages, based on the customer’s needs and financial profile.

How to Apply the Investec Private Banking Credit Card

- Research and Qualify: Research detailed information about the card, including fees, benefits and eligibility requirements. Make sure you meet the necessary income and credit criteria.

- Online or In-Person Application: Fill out an application form, either online through the official website or in-person at a bank branch, if available.

- Documentation: Prepare the required documents such as proof of income, personal identification and proof of address.

- Eligibility Assessment: The bank will assess your application and verify your credit information.

- Approval and Limits: If approved, you will receive a notification and a credit limit will be set.

- Receiving the Card: Upon approval, you will receive the card by mail.

- Activation: Follow the instructions to activate the card, usually through a specific phone or online.

- Start Using: Once activated, you can start using the card to make purchases and enjoy the benefits.

Remember to read the terms and conditions carefully and clear all doubts with the bank before applying for the card.

Conclusion

In conclusion, the Investec Private Banking Credit Card offers a compelling package of benefits tailored for high-income individuals seeking a sophisticated financial experience:

- Advantages: Competitive rates facilitate efficient financial management, while a robust rewards program allows for accumulation of points redeemable for travel and luxury items. Personalized concierge services enhance convenience with travel planning and reservations, complemented by VIP lounge access at airports. Additional perks like travel insurance and global assistance further elevate the card’s appeal.

- Considerations: Potential drawbacks include potentially higher interest rates compared to other cards, complex redemption processes for rewards, and eligibility limited to high-income individuals.

Overall, for those looking to elevate their financial status with personalized service, exclusive rewards, and premium perks, the Investec Private Banking Credit Card stands out as a comprehensive choice. Prospective cardholders should carefully evaluate whether its benefits align with their financial needs and lifestyle preferences.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply