The BMO Rewards® MasterCard is a powerful financial tool that offers a series of attractive benefits to its holders. With three notable advantages, it stands out in the world of credit cards.

Firstly, the card allows cardholders to accumulate points quickly and efficiently, earning up to 3 points for every dollar spent on eligible purchases. This feature makes the card especially valuable for those looking to maximize their rewards.

In addition, the generous sign-up bonus of 10,000 points after the first use of the card offers an immediate incentive to start enjoying the rewards. It’s like a welcome gift that boosts the cardholder’s experience.

The third advantage is redemption flexibility, with a conversion rate of 1 point equals 1 cent. This gives cardholders control over how they want to use their points, whether it’s for exciting trips, shopping, or writing off expenses on their bill.

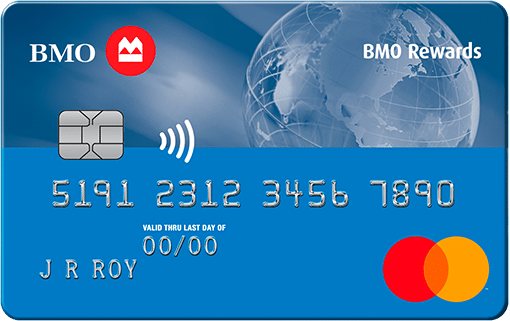

BMO Rewards® MasterCard

$0 annual fee Pay with PointsHow the BMO Rewards® MasterCard works

The BMO Rewards® MasterCard is a powerful financial tool that offers a number of attractive benefits to its holders. With its remarkable advantages, it stands out in the world of credit cards.

In short, the BMO Rewards® MasterCard is a solid choice for those who want to accelerate their rewards accumulation, enjoy immediate benefits and have the flexibility to choose how to make the most of their points. It’s a gateway to a world of experiences and savings.

Benefits of the BMO Rewards® MasterCard

The BMO Rewards® MasterCard offers several attractive advantages to its holders. Firstly, it makes it possible to accumulate points efficiently, awarding up to 3 points for every dollar spent on eligible purchases. This feature is valuable for maximizing rewards.

In addition, the card features a generous sign-up bonus of 10,000 points after the first use, providing an immediate incentive and tangible value to new cardholders.

The third major advantage is redemption flexibility, with a conversion rate of 1 point equals 1 cent. This allows cardholders to personalize their rewards, whether for travel, shopping or reducing their bill.

In summary, the BMO Rewards® MasterCard is a smart choice for those who want to accumulate rewards quickly, enjoy immediate benefits and have the freedom to choose how to use their points in a convenient and advantageous way. It’s a versatile card that offers countless opportunities to make the most of your everyday spending.

Disadvantages of the BMO Rewards® MasterCard

Although the BMO Rewards® MasterCard offers several notable advantages, there are also some disadvantages to consider.

Firstly, the card may have an annual fee, which can increase costs for some cardholders, especially if they don’t use the card often enough to offset this fee.

In addition, the interest rates associated with credit cards can be substantial, especially if cardholders don’t pay off the balance in full each month. This can result in significant financial charges over time.

Finally, the rewards program may have restrictions or limitations in terms of flight, hotel or product availability, which can limit redemption options.

Therefore, before opting for this card, it is essential to carefully assess whether the advantages outweigh the potential disadvantages, considering your spending habits and financial needs.

How to apply for the BMO Rewards® MasterCard

- Research and Comparison: Start by researching the BMO Rewards® MasterCard. Compare it to other credit card options to ensure it meets your financial and rewards needs.

- Eligibility: Check the card’s eligibility requirements, which may include a minimum credit score, minimum age, income and solid credit history.

- Online or Branch Application: Visit the official BMO Bank website (or a physical branch, if you prefer) and fill out the application form. Provide personal information such as name, address, income and employment history.

- Approval and Terms: After submitting the application, the bank will review your application and run a credit check. If approved, you will receive notification of the card’s terms, including credit limit and interest rate.

- Acceptance and Activation: If you agree to the terms offered, accept the card and follow the instructions to activate it, usually by phone or online.

- Responsible Use: Use the card responsibly, making punctual payments and maintaining an appropriate balance between available credit and spending.

Remember that the specific process may vary slightly depending on the financial institution and current policies.

Make sure you read all the terms and conditions before applying for the card and follow responsible financial practices when using it.

Conclusion

In conclusion, the BMO Rewards® MasterCard offers a range of benefits that make it a compelling choice for those seeking to maximize rewards and enjoy flexibility in their spending. The ability to earn points quickly, coupled with a generous sign-up bonus and redemption options, provides cardholders with tangible value and opportunities for savings.

However, it’s essential to consider potential drawbacks such as annual fees, interest rates, and redemption limitations before applying for the card. Conducting a thorough assessment of your spending habits and financial goals will help determine whether the advantages outweigh the disadvantages in your specific situation.

Ultimately, the BMO Rewards® MasterCard can be a powerful financial tool when used strategically, offering a gateway to rewards, savings, and personalized benefits tailored to your lifestyle.

Citi Double Cash® Credit Card

Citi Double Cash® Credit Card  Citi Double Cash® Credit Card

Citi Double Cash® Credit Card