CITI DOUBLE CASH CREDIT CARD

2% CASHBACK 0% ANNUAL FEEEach card has its own pros and cons that must be analyzed carefully. From benefits programs to cashback and points, there are many ways you can make the best out of your shopping experience with each of these.

What are the best credit cards for me?

Some of the best credit cards on the market offer great interest rates, reward programs and other benefits that can sound very appealing. But they aren’t available for everyone, since operators will only issue these cards to those they consider less risky.

Credit scores are one of the main deciding factors when it comes to cards. Bad or poor scores can put you back greatly and keep you from accessing the best options. That’s why we prepared this review according to that.

Smiling attractive middle aged woman, holding credit discount card, looking at smartphone screen, paying online, shopping in app, standing over white background.

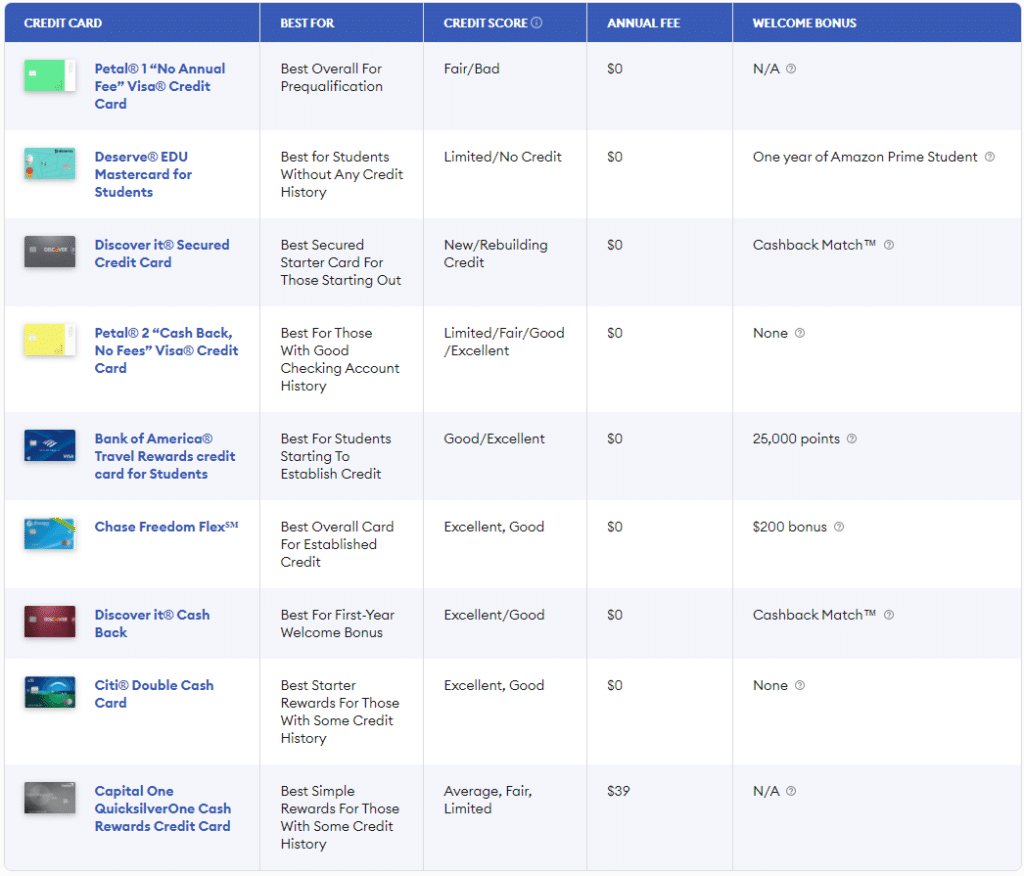

You’ll find bellow the best credit cards of the year according to your credit score to make a choise much easier!

Best credit cards in 2022 (pros and cons for you to choose)

We checked the best credit cards’ providers in the U.S. to bring the selection below. Keep reading!

Best credit cards for excellent credit scores

Credit scores close to 850 are considered excellent and get the top perks of the bunch on this selection. Not only that, but these individuals will have no shortage of offers from credit card companies, which means that the research can be even harder.

Never make a decision without looking at as many offers as possible. When choosing a credit card everything matters, specially interest rates and rewards programs that can help you waste less money.

- Upgrade Triple Cash Rewards Visa

This is a fee free card that stole the spotlight! It also has a great unlimited cashback program that you can use on every purchase. Whenever shopping for home, auto and health categories you can get up to 3% cashback! Other categories earn 1% of this benefit.

If you chose this option, there is a possibility of accessing your account via app to make monitoring easier. It also has contactless technology built in to make paying even easier.

- Upgrade Visa® Card with Cash Rewards

This card has US$0 annual, late transaction and international transaction fees, making it a great option for big purchases or even traveling. There is also no need for cash advances or cash advance fees to request this card.

When it comes to reward programs, you’re fully covered. Upgrade Visa includes 1,5% cashback for every purchase made with the card.

- Petal® 2 “Cash Back, No Fees” Visa® Credit Card

The no fees cards are in this year! Petal 2 has absolutely no fees to speak of and a great cashback program. As long as you pay on time for 12 months in a row you become eligible for up to 1,5% cashback on selected purchases. There is also 2% to 10% cashback available at a few merchants you can check on the card’s site or app.

Best credit cards for good credit scores

As long as you have a good credit score, there’s a wide variety of cards to choose from. All of our top picks for excellent scorers are also available here, but we included some more options that have tempting benefits.

- Oportun® Visa® Credit Card

You can apply to this card quickly, there’s no need for a security deposit or credit history analysis at first. For those who value safety this is also a great choice since there’s a Zero Fraud Liability clause that doesn’t hold you responsible for any unauthorized charges.

This is a great choice to start building credit history if you’re still new to cards. To help you further, the card offers support in English and Spanish 24/7.

- Milestone Gold Mastercard®

People who have good credit score have instant pre-qualification for this card. Which means it’s fast and easy to apply for this one, even without a perfect score (just good is enough). Other than that, it’s a perfect choice for building credit history since it reports your data to the three major bureaus in the U.S. - Milestone® Mastercard® – Mobile Access to Your Account

This is a very similar card to the one above, but it allows full access to your account 24/7 via mobile app. There is also a variety of card designs to choose from with no extra charge. If you’re a fan of personalized cards this is the option for you. - Credit One Bank® Platinum Visa®

And we’re back with some excellent choices for cashback programs. This card allows you to earn 1% cashback on gas, mobile service companies, cable and satellite TV as well as grocery purchases. There is a US$0 Fraud Liability clause which you can use in case of unauthorized buys.

Best credit cards for fair credit scores

So your credit score is a bit far from ideal, is that a dealer breaker when it comes to great credit card deals? Not exactly, there are still plenty of options that help you build better scores, improve your financial life and good interest rates.

- Merrick Bank Double Your Line™ Platinum Visa® Credit Card

Here we have an option that doesn’t need a security deposit and gives you a good deal for starting credit lines. At the beginning the value ranges from US$500 to US$1.500, but the prices can double as soon as your account qualifies.

You can also double your credit line by making the minimum payment monthly for the first 7 months of credit card.

- PREMIER Bankcard® Mastercard® Credit Card

For a great credit card, this option can get approved with scores many other financial institutions wouldn’t consider. There’s a quick 60 seconds application to take, once you’re over you’ll know if you’re approved or not. One of the best assets on this card is excellent client service and support that is there for you all day and night. - Fortiva® Mastercard® Credit Card

Who says that fair credit scores won’t get you cards with cashback rewards? This option offers up to 3% cashback depending on shop and type of purchase. You can also access your Vantage Credit Score for free while using this account. - Mission Lane Visa® Credit Card

Wondering if you’d apply for this Mission Lane card? Check if you apply without worries about your credit score, it won’t hurt you. After 6 months of payment on time you can get a higher and more advantageous credit line. There’s also an instant decision on your application, so no need to anxiously wait for approval. - Aspire® Cash Back Reward Card

Your day to day needs are fully covered and rewarded with this card, since there’s a 3% cash for purchases in:

Gas;

Groceries;

Utilities.

At first, there’s up to US$1.000 credit limits, but the amount is subject to credit approval. Pre-qualification doesn’t affect your credit score and there’s no need for a security deposit.

Best credit cards for poor credit scores

When we find out we have poor credit scores we often give up on acquiring the best credit cards. But with a bit of creativity, and help from a good card firm, it’s possible to even boost your scores through the best credit cards.

- Revvi Card

The monthly payments are manageable and you can earn up to 1% cashback on purchases. There’s an online application with fast response and possibility to improve credit scores by keeping payment before deadlines and below credit limits. - Merrick Bank Double Your Line™ Platinum Visa® Credit Card

Looking for good inicial credit lines? Merrick Bank Double Your Line has you covered with lines ranging from US$500 to US$1.350, with the possibility of doubling these numbers in the span of seven months by keeping monthly minimum payments. - Net First Platinum

Net First is a great choice for those who have been denied by other companies. Not only does it allow a US$750 initial credit line, it’s ideal for building up credit scores through monthly payments. There’s a fast application for anyone looking to get started. - Applied Bank® Unsecured Classic Visa® Card

In less than 60 seconds you can have a credit card that reports to all three major bureaus, which means it’s a chance to start building a stellar credit score from the ground up. By keeping monthly payments on date, you can also get additional limit. Plus, there’s no penalty fee, which means you won’t have to pay more for missing a payment date. - Mission Lane Visa® Credit Card

Are you constantly worried about how your financial decisions affect your scores? Mission Lane thought about that and made scores available for free online for every cardholder. It also gives you the possibility of getting additional credit limits after 6 months of timely payments, which allows you to build up scores even further.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply