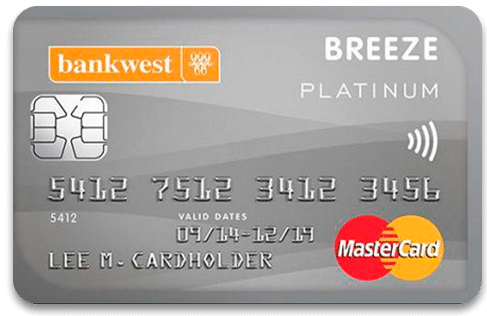

Bankwest Breeze Mastercard

0% intro P.A. No annual feeBankwest Breeze Mastercard is designed to make managing your finances a breeze. With its low annual fee and competitive interest rates, this card offers great value for money. The card also comes with a range of additional features, including complimentary insurance and a 24/7 concierge service.

One notable feature is the complimentary insurance coverage, which includes overseas travel insurance, purchase protection insurance, and extended warranty insurance. This coverage can provide peace of mind and save you money on additional insurance policies.

Furthermore, the card’s 24/7 concierge service is designed to assist you with a wide range of tasks, from booking travel arrangements to arranging dining reservations. This service can add convenience to your life and help you save time on various errands and tasks.

The power to breeze through your finances with Bankwest Breeze Mastercard

Additionally, the Bankwest Breeze Mastercard offers contactless payment technology, allowing for quick and easy transactions at compatible terminals. This feature is not only convenient but also helps to protect your card information by reducing the need to swipe or insert your card into a machine.

Pros and Cons

Pros:

- Low annual fee

- Competitive interest rates

- Complimentary insurance

- 24/7 concierge service

Cons:

- Foreign transaction fees

How do I know if Bankwest Breeze Mastercard is the best credit card for me?

To determine if Bankwest Breeze Mastercard is the best credit card for you, consider your spending habits and financial goals. If you’re looking for a card with a low annual fee and competitive interest rates, this card could be a good option. Additionally, if you value the convenience of a 24/7 concierge

In addition to the features mentioned, the Bankwest Breeze Mastercard also offers a range of other benefits that could make it a strong contender for your wallet. One such benefit is the card’s zero foreign transaction fees, making it an excellent choice for frequent travelers or online shoppers who purchase from international merchants.

Furthermore, the Bankwest Breeze Mastercard provides a competitive rewards program, allowing you to earn points for every dollar spent on eligible purchases. These points can be redeemed for a variety of rewards, including cash back, travel vouchers, and merchandise, providing flexibility to suit your preferences.

Another feature worth noting is the card’s contactless payment technology, which allows for quick and convenient transactions at compatible terminals. This can be especially useful for everyday purchases, adding to the card’s overall convenience and ease of use.

Overall, if you’re seeking a credit card with a low annual fee, competitive interest rates, complimentary insurance, a 24/7 concierge service, zero foreign transaction fees, a rewards program, and contactless payment technology, the Bankwest Breeze Mastercard could be an excellent choice for you.

Why do we like this card?

Bankwest Breeze Mastercard is known for its excellent value for money, offering a range of features at a low annual fee. In addition to its affordability, the card provides several additional benefits that enhance its appeal to customers.

One of the key benefits of the Bankwest Breeze Mastercard is its complimentary insurance offerings. Cardholders can enjoy peace of mind knowing that they are covered by complimentary overseas travel insurance, interstate flight inconvenience insurance, and transit accident insurance when they use their card to pay for travel expenses. These insurance benefits can help travelers save money on their trips and provide valuable coverage in case of unexpected events.

Another standout feature of the Bankwest Breeze Mastercard is its 24/7 concierge service. This service is available to assist cardholders with a wide range of requests, from booking travel arrangements to securing restaurant reservations. The concierge service can help cardholders save time and effort by handling these tasks on their behalf, making it a convenient option for busy individuals.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply