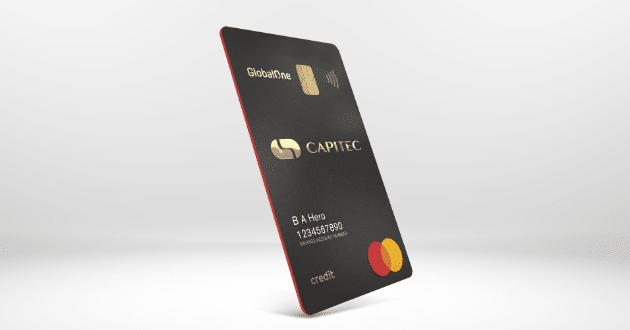

Capitec Credit Card

Credit limit of up to R250,000.00 Up to 55 days interest-free credit period after purchaseIn today’s dynamic financial landscape, having access to the right credit card can significantly impact your financial well-being.

Whether you’re aiming to build credit, manage expenses, or enjoy added convenience, selecting the perfect credit card is essential.

Introducing the Capitec Credit Card, a versatile financial tool designed to empower individuals with the flexibility and benefits they need to achieve their financial goals.

The Capitec Credit Card offers a comprehensive range of features tailored to meet the diverse needs of modern consumers.

From everyday purchases to unexpected expenses, this card provides the flexibility and convenience to manage your finances seamlessly.

With competitive interest rates and transparent fee structures, the Capitec Credit Card is designed to help you make the most of your financial resources.

Whether you’re consolidating debt, making a significant purchase, or covering day-to-day expenses, this card offers a practical solution to suit your needs.

In addition to its versatile features, the Capitec Credit Card provides a range of rewarding benefits to enhance your overall banking experience.

Earn rewards points on eligible purchases, enjoy exclusive discounts and offers from partner merchants, and access special financing options to help you achieve your financial goals.

Moreover, the card offers robust security features, including fraud protection and purchase protection, to safeguard your financial interests.

With the Capitec Credit Card, you can shop with confidence, knowing that your financial well-being is always protected.

Unlocking Financial Flexibility with the Capitec Credit Card

Pros and Cons

Pros

- Versatile features: Benefit from a comprehensive range of features designed to meet your diverse financial needs, from everyday.

- Rewarding benefits: Earn rewards points, enjoy exclusive discounts and offers, and access special financing options to help you achieve.

- Robust security: Rest easy with built-in security features, including fraud protection and purchase protection.

Cons

- Limited acceptance: While the Capitec Credit Card is widely accepted, there may be some merchants or establishments that do not accept it.

- Potential fees: While the card offers competitive interest rates and transparent fees, there may be additional charges for certain transactions or services.

How do I know if the Capitec Credit Card is Right for You?

The Capitec Credit Card is an excellent choice for individuals seeking a versatile and rewarding financial tool to help them achieve their financial goals.

If you value flexibility, convenience, and rewarding benefits, this card offers a practical solution tailored to your needs.

Additionally, if you prioritize security and peace of mind when managing your finances, the Capitec Credit Card delivers on its promises with robust security features and comprehensive protection.

By carefully assessing your financial goals and lifestyle preferences, you can determine if this card is the right fit for you. To determine if the Capitec Credit Card is right for you, assess your spending habits and financial needs.

Evaluate the benefits, such as purchase protection, travel insurance, and cashback options.Compare these features with other credit card options to ensure you’re getting the best value.

Additionally, think about your long-term financial goals and how the Capitec Credit Card can help you achieve them.

By carefully considering these factors, you can decide if this card suits your needs.

Why We Recommend This Card

The Capitec Credit Card stands out for its versatile features, rewarding benefits, and robust security features, making it a top choice for individuals looking to unlock their financial potential.

Whether you’re looking to earn rewards points, enjoy exclusive discounts, or simply manage your finances with confidence, this card offers everything you need and more.

In conclusion, the Capitec Credit Card is a powerful financial tool that empowers individuals to take control of their finances and achieve their goals.

With its flexible features, rewarding benefits, and robust security, this card is sure to enhance your overall banking experience and help you reach new heights of financial success.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply