Imagine if you had the opportunity to have a Black credit card capable of putting the world in your hands. Anyone would like to have a black card for the absurd benefits it delivers. And to make it even better, Discovery Bank has created one of the most amazing black cards that can help you immensely.

When we think of the Discovery Bank Black Card, we remember the wealth it brings to those who have it in their pocket, it’s absurd. Imagine having a private banker to take care of your finances and make important decisions for your money to multiply, it would be amazing, wouldn’t it? Well, that’s just a detail that this powerful credit card delivers.

Are you ready to get your own credit card with countless exclusive perks? We will explain exactly how Discovery Bank Black Card works, its advantages, disadvantages and why it might be useful for you. Read on for how to apply and other important information as well.

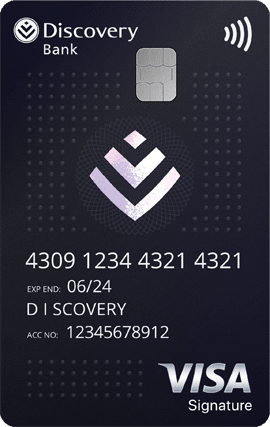

The Discovery Bank Black Card

Up to 55 days of interest-free shopping Get up to 75% off local flightsHow does the Discovery Bank Black Card work

When you have a credit card in hand, it comes with many features that may or may not fit into the life of the cardholder’s user. The Discovery Bank Black Card is no different, it has features that can make your life even easier and bring a healthy and amazing lifestyle to you and your family. Well, in this article I will tell you all the details about how it all works.

This black card is focused on the customer experience and ready to make you see the world in a new way, with better quality of life, purchasing power and differentiated status. In addition, you also have access to the unique Real Time Forex Accounts, available 24/7 in your banking app.

To make it even better, the Discovery Bank Black Card delivers a rewards program called Vitality Money, where you can enjoy six free visits a year to over 1,200 airport lounges worldwide for you and a guest. Amazing, isn’t it?

Main Advantages of using the Discovery Bank Black Card

The Discovery Bank Black Card is the best option for those who have an income between R$850,000 and R$2.5 million per year and want to experience the best opportunities and advantages that the world can provide. Check out some important advantages that you can enjoy with it in hand:

- Up to 55 days of interest-free shopping

- Get up to 75% off local flights

- Get up to 50% off international flights and access to over 1 200 luxury airport lounges worldwide

- Get a borrowing rate of up to prime -1%

- Up to 75%back on HealthyFood items at Pick n Pay or Woolworths

- Up to 50% back on HealthCare items in Clicks or Dis-Chem

- Up to 15% back on Uber rides

- Up to 15% cash back on your fuel purchases at BP and Shell

Cons of using the Discovery Bank Black Card

Everything in life has positives and negatives. The Discovery Bank Black card is no different. When it comes to the negative points of this credit card, we cannot help but say that compared to other cards, it is one of the less negative points.

The downside of having this credit card in your wallet is charging for withdrawals for local and international transactions, unlike other top-tier cards.

There is a fee of R65 on withdrawals, which is bad for you if you need to withdraw cash in small amounts and multiple times. They charge 2.75% as a conversion fee, while other banks charge 1.75%.

If none of this is meaningful to you, then go for it as the Discovery Bank Black card is for you.

How to Apply

As you can see, the Discovery Bank Black Card is a very powerful card for anyone who wants to make their life even easier when traveling by plane and enjoying all the benefits of life.

To get this card, you can apply on the bank’s website and fill in the forms. Approval is not time-consuming, and you will soon receive an approval or denial notification.

Conclusion

In conclusion, the Discovery Bank Black Card stands out as a prestigious option offering a wealth of benefits tailored for high-income earners. With perks like significant discounts on flights, access to luxury airport lounges, and a robust rewards program, it appeals to individuals seeking exclusive privileges and lifestyle enhancements.

However, potential applicants should weigh these advantages against the card’s fees, including withdrawal charges and currency conversion fees. These costs may impact the overall value depending on your financial habits and travel patterns.

Ultimately, if you meet the income requirements and can maximize the benefits offered, the Discovery Bank Black Card could be a powerful tool for enhancing your financial and travel experiences. It’s crucial to evaluate how well its features align with your personal needs and spending behavior before making a decision.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply