Having a credit card in hand today is one of the strongest demonstrations of financial power and a way to see life differently, with more brightness, giving you the chance to use high limits, in addition to enjoying various benefits such as discounts, rewards, cashbacks and more.

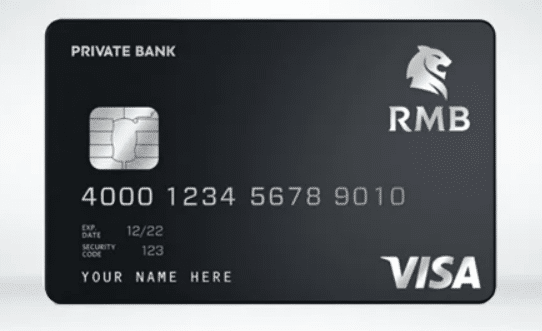

The RMB Standalone Credit Card is a complete credit card for you and your family. With it, you get huge benefits including travel benefits, lifestyle benefits, family benefits and banking benefits – with access to a dedicated private banker who is available 24/7.

With it in your wallet, you have a potential card that gives you a lot of financial power, with all the services at your disposal, being able to enjoy a wonderful life with your family, where they can also receive these benefits.

Are you ready to get your own credit card with countless exclusive perks? We will explain exactly how the RMB Standalone Credit Card works, its advantages, rewards, disadvantages and why it might be useful for you. Read about how to apply and other important information as well.

RMB Standalone Credit Card

Credit card available in metal Earn eBucks on all eligible credit card purchasesHow does the RMB Standalone Credit Card work

When you have a credit card in hand, it comes with many features that may or may not fit into the life of the cardholder’s user. The RMB Standalone Credit Card is no different as it has features that can make your life even easier and bring an amazing and healthy lifestyle in the palm of your hand. Well, in this article I will tell you all the details about how it all works.

To begin with, it is important to make it clear here that the RMB Standalone Credit Card offers the most exclusive service possible, providing a complete private banker experience, available 24/7, with a monthly fee of R258.00 and no transaction.

However, in order to have an RMB Standalone Credit Card, you must be over 18 years old and have a minimum income of R750,000 or more per year, or have a net asset value of more than R15 million. The benefits don’t stop there, you will automatically be participating in the eBucks rewards program, earning lots of cashbacks and discounts at partner stores such as Starbucks, Udemy, iStore, Engen, Checkers, among others.

It also has free visits per year to the SLOW Lounge, and the Bidvest Premier Lounge, depending on your reward level. With this credit card in hand, you can go further.

Main Advantages of using the RMB Standalone Credit Card

The RMB Standalone Credit Card is a credit card created for those who like to travel, like to take care of their financial life and even more like to receive special discounts, advantages and cashbacks. Check out some of the great advantages of this great credit card:

- Up to 55 days for interest-free purchases

- 5 additional cards at no extra charge

- Earn eBucks on all qualifying credit card purchases

- Enjoy complimentary access to SLOW and Bidvest Premier Lounges

- Get bonus Airport Lounge visits when you book flights with eBucks Travel

- Personalized and competitive interest rates

- Unlimited swipes at no charge

- Auto payment solution – Enjoy the convenience of having your credit card account paid on time, every time

With the RMB Standalone Credit Card in hand, you can enjoy all this and more. The advantages of having this card are practical and especially for those who think about having more credit power, more travel benefits, lifestyle and freedom.

Cons of using the RMB Standalone Credit Card

The RMB Standalone Credit Card is full of top-notch advantages, but it ends up not being that efficient in some ways – some, but that may influence your choice for this credit card.

To have access to this credit card, it is necessary to have a high income, preventing low and middle income people from obtaining the RMB Standalone Credit Card and enjoying the same benefits as those who have a higher monthly income.

In addition, it is also necessary to have a good credit score to get the RMB Standalone, as well as having a support to pay the median fees that come with it.

If that doesn’t make a difference to you, you can go ahead and find out how to get that powerful credit card.

Some Fees for the RMB Standalone Credit Card

The RMB Standalone Credit Card has some mandatory fees for some transactions carried out. Check out some of them here:

- Annual card fee – $25

- International ATM withdrawal – $5

- Card replacement (lost, stolen or damaged) – $10

- Balance enquiry $0.50

- Insufficient funds fee (ATM and Point-of-Sale transactions) – $0.80

These are some of the few fees that this amazing credit card requires. Learn how to apply for this card.

How to Apply

As you can see, the RMB Standalone Credit Card is a very powerful card for anyone looking to make their lives easier, offering greater benefits and rewards as you use it.

To get this card, you can apply on the bank’s website and fill in the forms. Approval is not time-consuming, and you will soon receive an approval or denial notification.

Conclusion

The Platinum Credit Card offers an array of exclusive benefits tailored for high-income individuals who love to travel and indulge in luxury services. With its high credit limit, personalized financial services, and extensive travel and shopping discounts, it is an ideal choice for those seeking premium financial products. However, it’s important to be aware of the associated fees, especially the high international transaction and agency fees.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply