Having a credit card can be a special advantage for those who do not have a high income and allows you to pay bills and make purchases with ease. There are basic, intermediate and higher level cards, but the credit card we are going to talk about in this article is top-notch.

This card is amazing for offering numerous perks for those who earn it, where the first one is the welcome bonus, where you get 10% cash back on all purchases in the first 3 months. As if that wasn’t good enough, it gets even better when you see that it offers a 4% reward on subscriptions and bill payments.

There is also a 2% reward on gasoline, daily trips, and 1% cash back on all your purchases, making it easy to monetize on every purchase, earning money as you spend. Finally, you also get good insurance terms, such as: high coverage for trip interruption and cancellation, lost or delayed luggage, flight delays, and more.

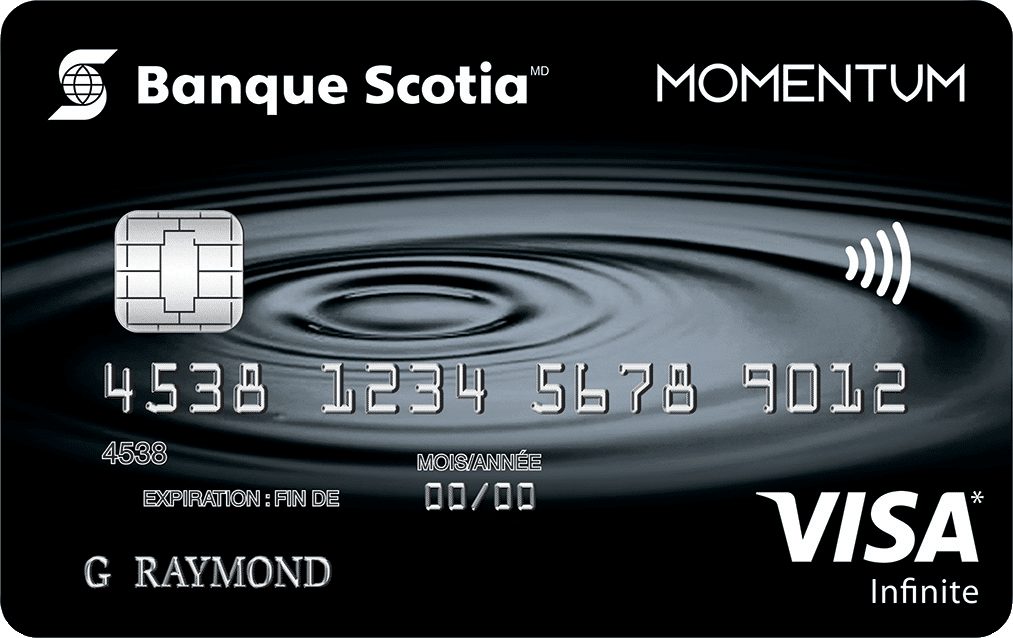

Main Advantages of using the Scotia Momentum Infinite Card

Scotia Momentum Infinite Card designed and created for people like you who need a full credit card, whether to use it frequently for shopping, travel and other leisure and lifestyle activities. Check out some dozens of benefits you get with this amazing credit card:

- No annual fee

- Get 10% cash back on all purchases

- Up to $1,000 coverage for mobile devices

- Earn 2% cash back on gas and transportation

- Purchase security and extended warranty protection

- Earn 4% cash back on groceries and recurring payments

- Earn 1% cash back on everything else with no cash back limit

- Visa Infinite benefits including concierge service and hotel upgrades

- 25% discount on car rentals at participating Avis and Budget locations

Once you have the Scotia Momentum Infinite Card in your hands, you will be able to enjoy all this and more.

Requirements for the Scotia Momentum Infinite Card

Credit card applications are approved or denied based on various factors. All companies have their own subscription requirements. See some of them here:

- Minimum income $60K/yr

- Household income $100K/yr

- Recommended credit score 660+

- You are a permanent Canadian resident and have reached the age of majority in the province in which you live.

How to Apply

As you can see, the Scotia Momentum Infinite Card is a very powerful card for anyone who wants to make their life even easier when it comes to air travel and all the benefits of life.

To get this card, you can apply on the bank’s website and fill out the forms. Approval is not time-consuming, and soon you will get notification of approval or denial.

Desert Financial Credit Union Visa Platinum – How to apply

Desert Financial Credit Union Visa Platinum – How to apply  Patelco Credit Union Mastercard® Rewards – How to apply

Patelco Credit Union Mastercard® Rewards – How to apply