The power of a credit card can make a difference in the lives of thousands of people, as they have greater purchasing power, get benefits and build a good credit score, with more room to enjoy for long periods of time.

On the other hand, this card is for people who like and are Harley Davidson fans, who don’t need to have a monthly income and high expenses to get this card, and can enjoy this card, besides getting a good credit limit and great facilities to buy H-D items, including discounts, special conditions, and much more.

Are you ready to find out everything about the Harley Davidson H-D Mastercard? We will explain how this amazing card works, its main advantages and some problems that may arise. Read on to find out how to apply and other important information as well.

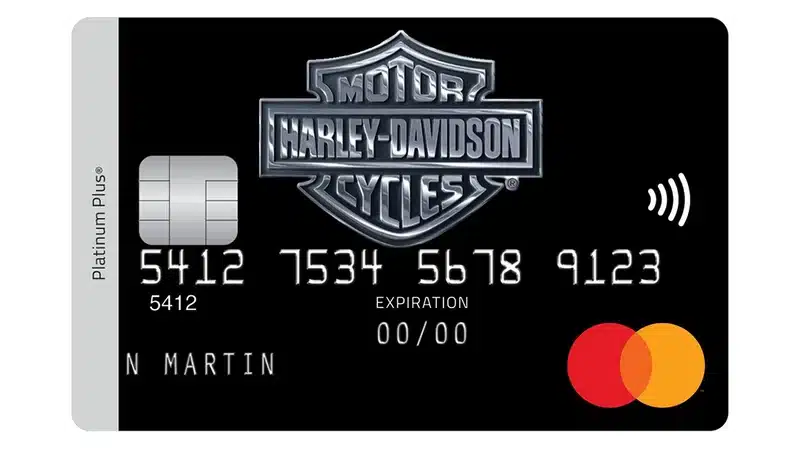

Harley Davidson H-D Mastercard

No annual fee 0% introductory APRHow does the Harley Davidson H-D Mastercard

You may be here in this article because you know that the Harley Davidson H-D Mastercard can offer a super special rewards program for motorcyclists and H-D fans and more. Well, all of that is true, which means that you can only win with this powerful credit card.

The Harley Davidson H-D Mastercard is a reward-filled, promotional card for people who love this brand and who buy various products from it, with no annual fee required. You can redeem your reward points, which you earn when you make your purchases, on various items, such as clothing and H-D products.

In addition, you can also earn Genuine Rewards points for every $2 spent on qualifying purchases, either on equipment or the bikes themselves, and gas stations as well. The MBNA Harley-Davidson Mastercard has an annual interest rate of 19.99% on purchases and 22.99% on balance transfers and cash advances.

Main Advantages of using the Harley Davidson H-D Mastercard

Harley Davidson H-D Mastercard designed and created for people like you who need a full credit card, whether to use it frequently for shopping, travel and other leisure and lifestyle activities. Check out some dozens of benefits you get with this amazing credit card:

- No annual fee

- Zero fraud liability

- 0% introductory APR

- Earn 1x point for every dollar spent

- Earn 3 points per dollar at H-D® dealerships

- H.O.G.® members earn 1 point for every mile ridden

- Earn 2% of each foreign purchase transaction or foreign ATM

- Earn $150 in H-D gift cards after spending $500 in the first 60 days of account opening

Once you have the Harley Davidson H-D Mastercard in your hands, you will be able to enjoy all this and more. The advantages of having this card are practical, especially for those who are thinking of taking advantage of the rewards it offers.

Requirements for the Harley Davidson H-D Mastercard

Credit card applications are approved or denied based on various factors. All companies have their own subscription requirements. See some of them here:

- Be a Canadian citizen or are a permanent resident

- Your name, residential status and contact information

- You’re at least the age of majority in your province or territory

- Your home address matches your credit report home address

If those fees don’t weigh you down, you can go ahead and learn how to apply for Harley Davidson H-D Mastercard.

How to Apply

As you can see, the Harley-Davidson H-D Mastercard is a very powerful card for anyone who wants to make their life even easier when it comes to all the benefits of H-D.

To get this card, you can apply on the bank’s website and fill out the forms. Approval is not time-consuming, and soon you will get notification of approval or denial.

Conclusion

In conclusion, the Harley Davidson H-D Mastercard offers enticing rewards and benefits tailored for Harley Davidson enthusiasts. With features like no annual fee, zero fraud liability, and a points system that favors purchases at H-D dealerships, it’s a compelling choice for fans of the brand.

However, potential applicants should consider factors such as the standard interest rates on purchases, balance transfers, and cash advances. It’s crucial to meet the eligibility criteria and understand the terms and fees associated with the card before applying.

Ultimately, if you’re a Canadian citizen or permanent resident who loves Harley Davidson products and can manage your credit responsibly, the Harley Davidson H-D Mastercard could be a valuable tool for earning rewards and enjoying perks associated with the brand.

Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply  RBC RateAdvantage Visa – How to apply

RBC RateAdvantage Visa – How to apply