Our exceptional security measures provide peace of mind to cardholders, ensuring that all their financial transactions are safe and secure.

With the latest advances in security technology, you can rest assured that your data is protected from fraud and theft.

Plus, our easy-to-use online interface offers easy account and payment management.

With just a few clicks, you can track your expenses, check your balance, and make payments conveniently. Effortlessly maintain full control of your finances, allowing you to focus on what really matters.

If you travel frequently, our Gold Royal Trust credit card is tailored for you.

Enjoy exclusive benefits such as lounge access at select airports, comprehensive travel insurance and 24-hour global assistance. Travel with confidence knowing that you are protected on all your trips.

How the Gold Royal Trust credit card works

The Gold Royal Trust credit card is a symbol of exclusivity and luxury issued by the renowned Gold Royal Trust bank. Designed for high-income and high-net-worth customers, the card is an expression of status and sophistication.

Made of 24-karat gold and weighing 22 grams, the card stands out for its beauty and uniqueness.

Its patented design and unique card number engraved on the reverse reflect the attention to detail and careful craftsmanship invested in its creation.

Although the Gold Royal Trust credit card works like any other credit card, it offers a number of benefits and rewards personalized to suit the needs and preferences of cardholders.

With a generous credit limit and low interest rate, the card offers its users financial flexibility.

Additionally, the absence of foreign transaction fees and late payment fees makes the card ideal for international travelers and people with busy schedules.

However, it is important to note that the Gold Royal Trust credit card cannot be applied for online or at conventional bank branches.

It is only offered by invitation to a select group of Gold Royal Trust Bank clients who meet the criteria established by the entity.

Due to its exclusivity, the card is limited to a restricted number of cardholders, making it a true gem in the world of credit cards.

Main advantages of the Gold Royal Trust credit card

The Gold Royal Trust credit card is a premium option that offers a wide range of benefits and exclusive features, providing a differentiated experience to its cardholders.

With the Gold Royal Trust credit card , you can enjoy numerous privileges and advantages designed to make your travels more comfortable and convenient, as well as offering generous rewards.

Royal Trust Card benefits include:

- 1. Annual airline credit: The card offers an annual credit that can be used for air travel-related expenses, such as tickets, baggage fees or upgrades.

- 2. Global Entry or TSA PreCheck Credit: The card covers the registration fee for the Global Entry or TSA PreCheck program, which allows faster and more comfortable passage through customs and airport security.

- 3. Access to airport lounges: With the card, you will have access to VIP lounges at participating airports around the world, where you can enjoy comfort, amenities and exclusive services.

- 4. Luxury travel services: The card offers various luxury travel services, such as travel assistance, hotel reservations, car rentals and access to exclusive experiences.

- 5. Luxury Card Concierge: A dedicated team is available 24 hours a day to assist with special requests, such as reservations at renowned restaurants, tickets to exclusive events and other personalized needs.

- 6. Rewards Program: Each purchase made with the card accumulates points that can be redeemed for travel, products, services or bill credit.

- 7. Advantages in purchases and restaurants: The card offers additional advantages in purchases, such as discounts at selected stores, access to pre-sales of exclusive products and special offers at partner restaurants.

Main disadvantages of the Gold Royal Trust credit card

The Gold Royal Trust credit card offers a number of exclusive advantages and benefits, but it also has some disadvantages and limitations to take into account. It’s important to know these things before deciding if the card is right for you.

These are some of the disadvantages and limitations of the card:

- 1. High annual fee: The Royal Trust Gold has a significantly high annual fee of $995. This can be a deterrent for people who don’t travel often or don’t take advantage of all the benefits the card offers. It is essential to consider whether the annual fee is justified by the benefits that are intended to be used.

- 2. Strict eligibility criteria: The Royal Trust Gold card is only available by invitation and has strict eligibility criteria. This means that it is not widely available to the general public. You will have to meet certain bank-specific requirements to be considered for the card.

- 3. Limited acceptance: Due to its unique composition of 24-karat gold, the card may have acceptance problems in businesses or establishments that are not familiar with handling such distinctive cards. It’s important to check card acceptance in places where you plan to use it frequently.

- 4. Not suitable for people on a tight budget: The Gold Royal Trust is a luxury-oriented card and may not be the best option for people who want to spend more money.

How to apply for a Gold Royal Trust credit card

The Gold Royal Trust credit card is an exclusive offer available by invitation only.

If you have received an invitation to apply for the card, these are the steps you can follow to start the application process:

- 1. Review the invitation: Carefully read the invitation you have received. Make sure you understand all terms, benefits and any special instructions provided by Gold Royal Trust Bank.

- 2. Confirm your eligibility: Check that you meet the eligibility criteria specified in the invitation. This may include financial requirements, credit score references and other criteria defined by the bank. Make sure you meet the criteria before continuing.

- 3. Contact the bank: Use the contact information provided in the invitation to contact Gold Royal Trust Bank. Let them know your interest in applying for the Gold credit card and ask about the application process.

- 4. Submit required documents: The bank may request additional documents to evaluate your application. Prepare and submit all necessary documents requested. This may include proof of income, personal identification and other relevant information.

- 5. Wait for approval: After submitting your application and documents, wait patiently for the bank’s response. Please remember that Gold Royal Trust credit card approval is not guaranteed as it depends on several factors determined by the bank, such as credit analysis and assessment of your ability to pay.

- 6. Follow additional instructions: If your application is approved, the bank will provide you with additional instructions on how to activate and use the card.

It is important to remember that these steps are specific to applying for the Gold Royal Trust credit card by invitation. If you have not received an invitation, you will not be able to apply for the card directly. In this case, you can consider other credit card options available in the market.

You will remain on this website.

How to apply for SBI Credit Card

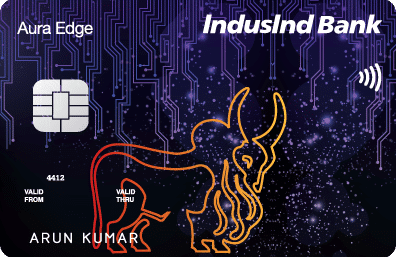

How to apply for SBI Credit Card  How to apply for Indusind Bank Credit Card

How to apply for Indusind Bank Credit Card