With each passing day, people want to have a credit card in their hands to obtain more financial power, more advantages, a specific objective according to the user’s need – whether it’s traveling with more discounts and benefits, receiving lifestyle benefits or just have more credit limit.

If you are looking for a credit card that can provide you with a better lifestyle, with a great and sustainable financial life, in addition to more financial power and receiving numerous forms of rewards, you are in the right place. The Discovery Bank Platinum Card is here to give you all that and more.

Are you ready to get your own credit card with countless exclusive perks? We will explain exactly how the Discovery Bank Platinum Card works, its advantages, rewards, disadvantages and why it might be useful for you. Read on for how to apply and other important information as well.

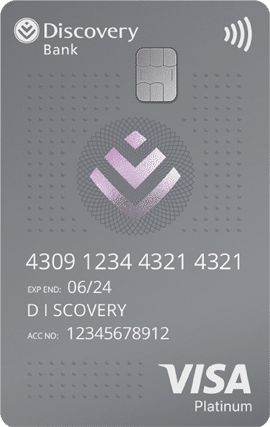

The Discovery Bank Platinum Card

Up to 55 days of interest-free shopping Get up to 60% off local flightsHow does the Discovery Bank Platinum work

You may be here in this article because you know that Discovery Bank Platinum Card can offer you a super special travel benefits program as well as other exclusive benefits. Well, that’s all true, which means that you only have to gain from this credit card. Well, in this article I will tell you all the details about how it all works.

The Discovery Bank Platinum Card was designed, conceived and created for people with high incomes who need to take care of their money, invest better, earn more money, and of course, enjoy many discounts and a greater lifestyle. It delivers more rewards than Discovery Bank Gold, with increasing percentages and additional exclusive benefits.

You’ll be able to get discounts on local flights, cash back on the latest iPhone, up to 75% off Nike fitness devices and performance equipment, and a world of extra benefits.

Main Advantages of using the Discovery Bank Platinum

Discovery Bank Platinum Card is the best option for anyone who wants to have a bigger map of advantages in the world of credit cards, especially when it comes to air travel and lifestyle benefits. Check out some important advantages that you can enjoy with it in hand:

- Up to 55 days of interest-free shopping

- Up to 15% back on Uber rides

- Get up to 60% off local flights

- Up to 50%back on HealthyFood items at Pick n Pay or Woolworths

- Up to 50% back on HealthCare items in Clicks or Dis-Chem

- Up to 15% cash back on your fuel purchases at BP and Shell

- Up to 75% off Nike fitness devices and performance equipment

- Get up to 40% off when you spend your Discovery Miles

Once you have the Discovery Bank Platinum Card in your hands, you can enjoy all this and more. The advantages of having this card are practical, especially for you.

Cons of using the Discovery Bank Platinum

Everything in life has positives and negatives. The Discovery Bank Platinum card is no different. When it comes to the negative points of this credit card, we can’t help but say that compared to other cards, it has one of the least negative points.

The downside to having this credit card in your wallet is that it doesn’t cover your line of credit in case your credit card is stolen in an armed robbery, unlike other credit cards.

In addition, it also charges high monthly and transaction fees, as well as mostly charging 9x more to issue a new Discovery Bank card – relative to other top-tier cards.

If none of this is meaningful to you, then go for it as the Discovery Bank Platinum card is for you.

How to Apply

As you can see, the Discovery Bank Platinum Card is a very powerful card for those who want to make life even easier when it comes to benefits in all areas, helping you with your financial life and with huge discounts.

To get this card, you can apply on the bank’s website and fill in the forms. Approval is not time-consuming, and you will soon receive an approval or denial notification.

Conclusion

In conclusion, the Discovery Bank Platinum Card offers substantial advantages for high-income individuals seeking extensive travel and lifestyle benefits. With features like significant discounts on flights, cashback on Uber rides, and savings on groceries and healthcare items, it caters well to frequent travelers and those who prioritize health and fitness.

However, potential applicants should weigh these benefits against the card’s drawbacks, such as high fees and limited theft coverage. These factors may influence the overall suitability of the card based on individual financial needs and spending habits.

Ultimately, if the benefits align with your lifestyle and the fees are manageable, the Discovery Bank Platinum Card can provide significant value through its rewards and perks. It’s advisable to carefully review all terms and conditions before applying to ensure it meets your specific financial goals and preferences.

8 Smart Ways to Shop Smarter and Save More Cash

8 Smart Ways to Shop Smarter and Save More Cash  9 Keys to Choosing a Loan That Fits Your Monthly Cash Flow

9 Keys to Choosing a Loan That Fits Your Monthly Cash Flow