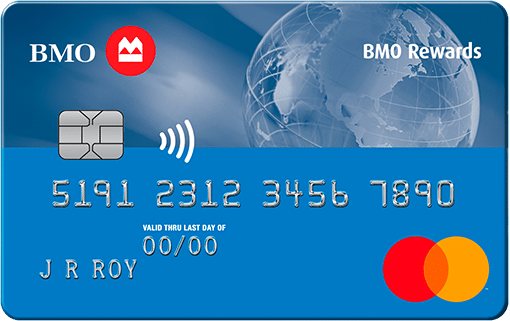

BMO Rewards® MasterCard

$0 annual fee Pay with PointsIn today’s world of financial choices, having the right credit card can significantly enhance your rewards potential.

From earning points to accessing valuable benefits, finding the perfect card is essential. Introducing the BMO Rewards® MasterCard.

A financial tool designed to empower you to maximize your rewards while enjoying a range of exclusive benefits.

With its versatile rewards program and tailored features, the BMO Rewards® MasterCard stands out as a reliable companion in your financial journey.

Whether you’re a frequent shopper looking to earn points on everyday purchases or a savvy traveler seeking valuable travel perks, this card offers a solution tailored to your needs.

In this article, we’ll explore the myriad benefits of the BMO Rewards® MasterCard, including its rewards program, features, and additional benefits.

We’ll also discuss considerations to help you determine if this card is the right fit for you. So, let’s dive in and discover how the BMO Rewards® MasterCard can elevate your rewards experience.

Elevating Your Rewards Experience with BMO Rewards® MasterCard

Pros and Cons

Pros

- Rewarding rewards program

- Flexible redemption options

- Additional benefits

Cons

- Annual fee

- Limited acceptance

How do I know if BMO Rewards® MasterCard is the best credit card for me?

Determining if the BMO Rewards® MasterCard is the right credit card for you involves assessing various factors tailored to your spending habits, lifestyle, and financial goals.

If you frequently make purchases in categories such as groceries, gas, dining out, or travel, this card’s rewards program could be highly beneficial for you.

The ability to earn BMO Rewards points on everyday purchases and redeem them for a variety of rewards can add significant value to your spending.

You may have access to additional benefits such as airport lounge access or concierge service, which can enhance your overall cardholder experience.

The BMO Rewards® MasterCard offers various perks, including travel insurance coverage, purchase protection, and access to exclusive BMO offers and discounts. Additionally, depending on the specific BMO Rewards® MasterCard variant you choose.

With the BMO Rewards® MasterCard, you earn BMO Rewards points on all purchases, with accelerated earning rates on specific categories.

These points can be redeemed for travel, merchandise, gift cards, statement credits, and more, providing flexibility in how you use your rewards to suit your preferences and lifestyle.

Evaluate the annual fee and any associated costs. While some BMO Rewards® MasterCard variants may have an annual fee.

The rewards, benefits, and cost-saving opportunities provided by the card may outweigh this expense, especially if you can maximize the rewards and benefits offered.

Think about your comfort level with BMO Bank of Montreal and their customer service. BMO is one of Canada’s largest banks and is known for its excellent customer service and reliability. If you prefer banking with a well-established institution, this card may be a good fit for you.

Ultimately, the decision to choose the BMO Rewards® MasterCard as your preferred credit card should align with your individual preferences, spending habits, and financial goals.

Why do we like this card?

The BMO Rewards® MasterCard stands out for its rewarding rewards program, flexible redemption options, and additional benefits.

Whether you’re earning points on everyday purchases, redeeming rewards for travel or merchandise, or enjoying purchase protection and travel insurance, this card delivers on its promises.

With its focus on rewarding spending and providing added convenience and value, the BMO Rewards® MasterCard offers exceptional benefits to cardholders seeking to elevate their rewards experience.

In conclusion, the BMO Rewards® MasterCard is a top-tier credit card option for individuals seeking a versatile rewards program, flexible redemption options, and valuable benefits.

With its focus on rewarding spending and enhancing the overall rewards experience, this card offers a compelling value proposition for discerning consumers.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply