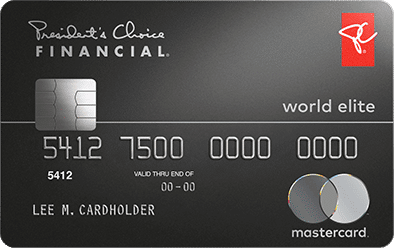

PC Financial® World Elite Mastercard®

No annual fee 21 days Interest-freeIn today’s fast-paced world, navigating the myriad of financial options can be overwhelming. From credit cards to prepaid cards, the choices seem endless.

However, finding the right card that not only fits your lifestyle but also maximizes your rewards potential is paramount.

Enter the PC Financial® World Elite Mastercard®, a financial tool designed to empower you to make the most of your spending while enjoying a host of exclusive benefits.

With its enticing rewards program and premium perks, the PC Financial® World Elite Mastercard® stands out as a beacon of financial freedom in a sea of options.

Whether you’re a savvy shopper looking to earn points on everyday purchases or a frequent traveler in search of travel benefits and comprehensive insurance coverage, this card offers a solution tailored to your needs.

In this article, we’ll delve into the myriad benefits of the PC Financial® World Elite Mastercard®, exploring its rewards program, travel perks, and concierge service.

We’ll also discuss the considerations to keep in mind when determining if this card is the right fit for you.

So sit back, relax, and discover how the PC Financial® World Elite Mastercard® can elevate your financial experience to new heights.

Unlocking Your Financial Potential with PC Financial® World Elite Mastercard®

Pros and Cons

Pros

- Generous rewards program

- No annual fee

- Travel benefits

Cons

- Limited acceptance

- Redemption restrictions

How do I know if PC Financial® World Elite Mastercard® is the best credit card for me?

First off, let’s consider your spending habits. Are you someone who frequently shops at Loblaws-owned grocery stores like Real Canadian Superstore, No Frills, or Shoppers Drug Mart?

With the PC Financial® World Elite Mastercard®, you earn PC Optimum points on every purchase you make, which can add up quickly when you’re stocking up on groceries, household essentials, and more.

Next, think about your travel habits. Do you enjoy jetting off on vacations or weekend getaways?

The PC Financial® World Elite Mastercard® offers additional benefits for travelers, such as travel insurance coverage and access to exclusive travel offers and discounts.

If you’re someone who loves to explore new destinations and experiences, these travel perks could be a valuable addition to your credit card arsenal.

Are you looking for a credit card that offers valuable rewards without charging an annual fee?

The PC Financial® World Elite Mastercard® doesn’t have an annual fee, making it a cost-effective option for earning rewards on your everyday purchases.

Plus, with no foreign transaction fees, you can shop worry-free when traveling abroad.

Lastly, think about the flexibility you desire in a credit card rewards program. With the PC Financial® World Elite Mastercard®.

You have the freedom to redeem your PC Optimum points for a wide range of rewards, including groceries, merchandise, travel, and more.

Whether you want to use your points to stock up on essentials or treat yourself to a well-deserved vacation, the choice is yours.

Why do we like this card?

The PC Financial® World Elite Mastercard® stands out for its generous rewards program, no annual fee, and travel benefits.

Whether you’re earning points on everyday purchases, enjoying premium travel perks, or saving money on international transactions, this card delivers on its promises.

With its combination of rewards, benefits, and premium features, the PC Financial® World Elite Mastercard® offers exceptional value to cardholders who prioritize maximizing their rewards potential and enhancing their overall lifestyle.

The PC Financial® World Elite Mastercard® is a top-tier credit card option for individuals seeking a robust rewards program, premium perks, and comprehensive insurance coverage.

With its focus on maximizing rewards and providing added convenience and protection, this card offers a compelling value proposition for discerning consumers.

Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply