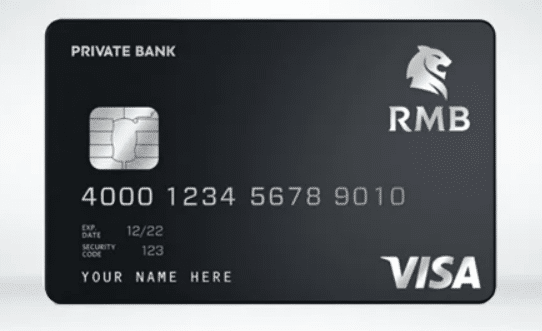

RMB Standalone Credit Card

Credit card available in metal Earn eBucks on all eligible credit card purchasesIn today’s ever-evolving financial landscape, having a credit card that offers flexibility, convenience, and rewards is essential for managing your finances effectively.

The RMB Standalone Credit Card is designed to meet the needs of individuals seeking a reliable financial solution.

Whether you’re looking to streamline your expenses, earn rewards on your purchases, or access exclusive benefits, this card provides the tools and features to support your financial journey.

With the RMB Standalone Credit Card, managing your expenses becomes simpler and more efficient.

Say goodbye to carrying cash or constantly monitoring your bank account balance with this card, you can make purchases with ease and confidence.

Whether you’re shopping online, dining out, or paying bills, the RMB Standalone Credit Card offers a convenient and secure payment solution for all your financial needs.

Empower Your Financial Independence with the RMB Standalone Credit Card

Pros and Cons

Pros

- Streamlined expenses: Simplify your spending and manage your finances more efficiently with the RMB Standalone Credit Card.

- Reward opportunities: Earn rewards on every purchase and redeem them for a variety of options, enhancing the value of your spending.

- Exclusive benefits: Access complimentary travel insurance, purchase protection, and exclusive discounts, adding convenience and value to your card membership.

Cons

- Limited rewards redemption options: The RMB Standalone Credit Card may have limited options for redeeming rewards compared to other cards in the market.

- Potential fees: Depending on the card terms and conditions, there may be annual fees or other charges associated with the RMB Standalone Credit Card, which could impact overall cost savings.

How Do I Know if the RMB Standalone Credit Card is the Best Credit Card for Me?

Determining if the RMB Standalone Credit Card is the best credit card for you depends on your financial goals, spending habits, and lifestyle preferences. If you value simplicity, convenience, and the opportunity to earn rewards on your everyday purchases, this card could be an excellent fit for your needs.

Consider your spending patterns, reward preferences, and the specific features and benefits offered by the card to determine if it aligns with your financial goals and lifestyle.

Additionally, if you’re looking for a card that offers exclusive benefits and privileges, such as travel insurance and purchase protection.

Evaluate the card’s features and benefits against your financial priorities to determine if it meets your requirements and offers the value you seek in a credit card.

Every time you use your RMB Standalone Credit Card, you have the opportunity to earn rewards.

Whether it’s cashback, points, or miles, this card rewards you for your spending.

Accumulate rewards on everyday purchases and redeem them for a variety of options, including travel, gift cards, merchandise, or statement credits.

By maximizing your rewards potential, you can make your money work harder for you and enjoy additional benefits from your spending.

As a cardholder, you gain access to a range of exclusive benefits and privileges designed to enhance your overall experience.

Enjoy perks such as complimentary travel insurance, extended warranty protection, and purchase protection on eligible purchases.

Why Do We Like This Card?

We like the RMB Standalone Credit Card for its simplicity, convenience, and rewards potential.

This card offers a straightforward and hassle-free way to manage your expenses, making it ideal for individuals looking for a reliable financial solution.

The opportunity to earn rewards on every purchase adds value to your spending and allows you to maximize your benefits from using the card.

Additionally, the RMB Standalone Credit Card provides access to exclusive benefits and privileges that enhance your overall experience.

From complimentary travel insurance to purchase protection and exclusive discounts, these perks add an extra layer of convenience and value to your card membership.

Whether you’re shopping, traveling, or dining out, this card offers the features and benefits to support your financial independence and lifestyle needs.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card