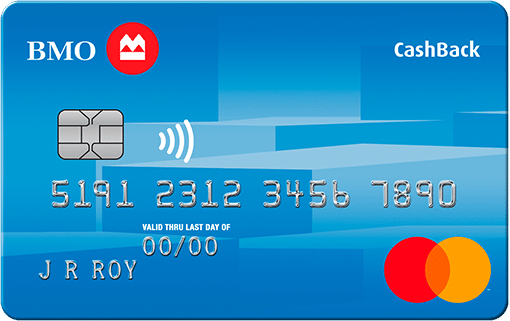

BMO Cashback Mastercard

No annual fee Solid welcome offerIn the world of credit cards tailored for savvy spenders, the BMO Cashback Mastercard isn’t just another option; it’s like finding a hidden gem in a sea of choices.

It’s all about simplicity and rewards, making managing your finances feel like a breeze. Whether you’re stocking up on groceries, treating yourself to a meal out, or browsing online for your next purchase, this card has your back, rewarding you for every swipe you make.

But it’s not just about the cashback rewards; it’s also about the little extras that make every transaction feel extra special. With features like purchase protection and extended warranty coverage, you can shop with peace of mind, knowing you’re covered in case anything goes awry.

And let’s not forget about the cherry on top: no annual fee, making it a no-brainer for those of us who want to maximize rewards without breaking the bank.

Maximizing Your Cashback Rewards with BMO Cashback Mastercard

Pros and Cons

Pros

- Straightforward cashback rewards program

- No annual fee

- Purchase protection and extended warranty coverage

Cons

- Potentially lower cashback rewards rate

- Foreign transaction fees may apply

How do I know if BMO Cashback Mastercard is the best credit card for me?

Deciding if the BMO Cashback Mastercard is your perfect match really comes down to understanding how you spend your money and what matters most to you financially.

If you’re all about keeping things simple and love the idea of earning cashback rewards on everything you buy without having to stress about an annual fee, then this card might just be your saving grace. It’s like having a trusted sidekick that rewards you for just being you.

But if you’re someone who’s all about squeezing every last drop of cashback rewards from your purchases and don’t mind paying an annual fee for those premium perks, there are other cashback cards out there that might tick all your boxes. It’s all about finding the card that fits seamlessly into your lifestyle and financial goals, making every swipe feel like a step towards financial freedom.

Why do we like this card?

We’re giving two thumbs up to the BMO Cashback Mastercard, and here’s why: it’s like the MVP of simplicity and rewards, with no annual fee and perks that are as user-friendly as they come.

Whether you’re all about stretching every dollar or just want to make managing your finances a breeze, this card is like a trusty companion that’s got your back every step of the way.

For folks who are all about getting the most bang for their buck, this card is like a dream come true. With its straightforward rewards program, earning cashback on your everyday purchases feels like second nature.

And let’s not forget about the cherry on top: no annual fee, making it a no-brainer for those of us who want to keep things simple without any extra costs.

But it’s not just about the rewards; it’s also about the experience. Whether you’re a budget-conscious consumer or a seasoned spender, this card offers a solution that’s as compelling as it is convenient. It’s like having a financial ally in your corner, helping you make the most of every dollar and every swipe.

Oportun Visa® Credit Card – How to apply

Oportun Visa® Credit Card – How to apply  Fortiva® Mastercard® Credit Card

Fortiva® Mastercard® Credit Card  Mercury Mastercard – How to apply

Mercury Mastercard – How to apply